The standard yearly property tax rate in Montenegro ranges from 0.25% to 1% of your property’s assessed market or cadastral value. As of September 2025, most residential properties fall within this bracket, with municipalities setting their specific rate within this range.

The standard yearly property tax rate in Montenegro ranges from 0.25% to 1% of your property’s assessed market or cadastral value. As of September 2025, most residential properties fall within this bracket, with municipalities setting their specific rate within this range.

The 21% tax in Montenegro usually refers to the standard Value-Added Tax (VAT) rate.

Here’s a breakdown of how it works:

The 21% tax in Montenegro usually refers to the standard Value-Added Tax (VAT) rate.

Here’s a breakdown of how it works:

Yes, Montenegro does have a capital gains tax. The specifics depend on whether you are an individual or a legal entity, whether the gains are from real estate, securities, etc., and whether any exemptions apply.

Yes, Montenegro does have a capital gains tax. The specifics depend on whether you are an individual or a legal entity, whether the gains are from real estate, securities, etc., and whether any exemptions apply.

Objectives: comfort, legal safety, predictable running costs, and residency possibilities.

Key points/recommendations:

Objectives: comfort, legal safety, predictable running costs, and residency possibilities.

Key points/recommendations:

Objectives: net yield, tax efficiency, predictable exit taxes.

Key points/recommendations:

Objectives: net yield, tax efficiency, predictable exit taxes.

Key points/recommendations:

Purchase price: €500,000

Purchase price: €500,000

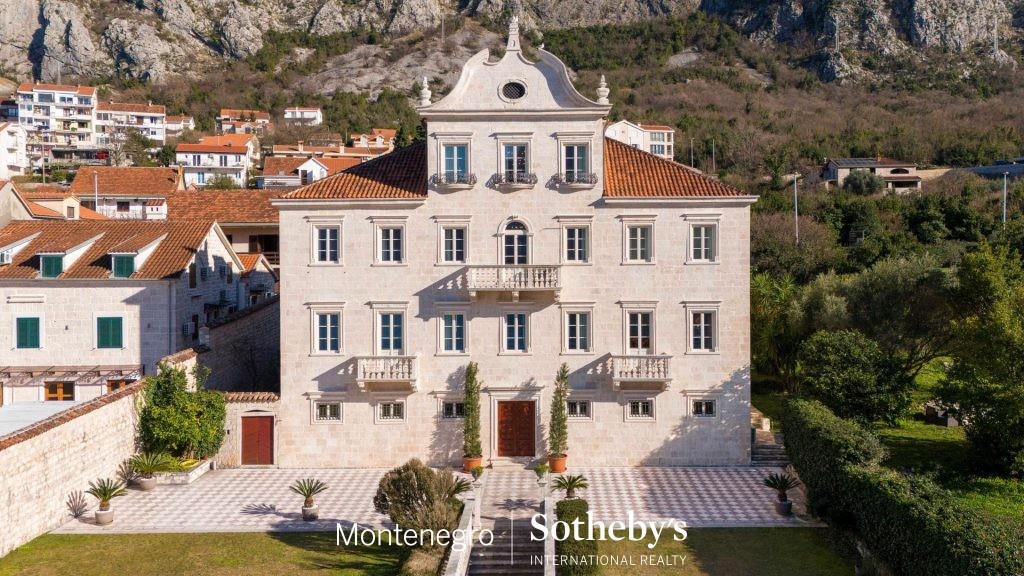

Montenegro blends a Mediterranean lifestyle with investor-friendly fiscal simplicity. For owner-occupiers, the numbers usually translate into manageable holding costs; for investors, the predictable 15% capital-gains and clear rental-income rules make modelling returns straightforward—provided you run the numbers with the right local advice. At Sotheby’s Realty, we pair boutique market knowledge (locations, finishing, seasonal demand) with trusted local legal and tax specialists so every purchase is both beautiful and secure.

Montenegro blends a Mediterranean lifestyle with investor-friendly fiscal simplicity. For owner-occupiers, the numbers usually translate into manageable holding costs; for investors, the predictable 15% capital-gains and clear rental-income rules make modelling returns straightforward—provided you run the numbers with the right local advice. At Sotheby’s Realty, we pair boutique market knowledge (locations, finishing, seasonal demand) with trusted local legal and tax specialists so every purchase is both beautiful and secure.