Montenegro’s EU accession is expected to increase property values by improving legal certainty, infrastructure investment, foreign capital inflows, and tourism demand. Luxury and prime coastal real estate are likely to benefit the most, as EU alignment reduces risk and attracts long-term international investors.

Montenegro’s path toward European Union (EU) accession is one of the most important long-term drivers of property value growth in the country. For luxury real estate investors, EU alignment signals structural change: stronger institutions, improved infrastructure, deeper capital markets, and rising international demand.

This guide explains — in clear terms — how EU accession could affect Montenegro property prices, investment risk, rental demand, and long-term returns.

What Is Montenegro’s EU Accession Status?

Montenegro is an official EU candidate country and has opened all negotiating chapters required for membership. The country is actively aligning its laws, institutions, and economic systems with EU standards.

Montenegro already uses the euro, which reduces currency risk and supports investor confidence.

EU accession is not speculative — it is a structured, ongoing process that already influences economic and real estate policy.

How Does EU Accession Affect Property Values?

EU accession typically increases property values through:

-Improved legal certainty

-Higher foreign investment

-Infrastructure upgrades

-Increased tourism and mobility

-Lower long-term investment risk

In Montenegro, this effect is expected to be strongest in prime coastal and luxury markets.

EU accession tends to raise property prices by reducing risk and increasing demand, especially in prime and luxury real estate markets.

Why Legal Harmonization Matters for Investors?

As part of EU integration, Montenegro is strengthening:

-Property rights enforcement

-Land registry transparency

-Contract and dispute resolution

-Anti-corruption measures

-Urban planning and zoning rules

For investors, this lowers the “risk discount” historically applied to non-EU markets.

EU legal alignment increases investor confidence and typically leads to higher real estate valuations over time.

Which Property Segments Benefit Most from EU Accession?

Not all property types respond equally to EU integration.

Most positively affected segments include:

Luxury waterfront villas

High-end apartments in established coastal towns

Branded residences and marina developments

Prime urban real estate with international appeal

Secondary and poorly located assets benefit less. Luxury and prime-location properties benefit most from EU accession due to international demand and limited supply.

How Infrastructure Investment Impacts Real Estate Prices?

EU accession unlocks access to European infrastructure funding, which supports:

-Transport connectivity (roads, airports, ports)

-Utilities and energy systems

-Digital infrastructure

-Sustainable development projects

Improved infrastructure expands demand beyond traditional hotspots and supports price growth.

EU infrastructure funding increases accessibility and livability, which raises property demand and values.

What Happens to Foreign Investment After EU Accession?

EU accession increases foreign investment, which supports long-term property price growth. EU alignment typically attracts:

-Institutional investors

-International developers

-Cross-border buyers

-Long-term capital seeking stable returns

As capital inflows increase, competition for prime assets intensifies.

Does Montenegro EU Accession Increase Rental Demand?

Yes. Montenegro EU accession supports rental demand through:

-Higher tourism volumes

-Increased business travel

-Digital nomads and professionals

-Longer average stays

Luxury rental properties in coastal and lifestyle destinations are positioned to benefit most.

EU accession increases rental demand by boosting tourism, mobility, and international presence.

Are There Risks During the EU Accession Process?

Yes, but they are transitional rather than structural.

Key risks include:

-Slower permitting during regulatory alignment

-Higher construction and compliance costs

-Short-term market pauses before price acceleration

-For long-term investors, these risks often create entry opportunities.

EU accession can cause short-term regulatory friction, but long-term effects are generally positive for property values.

Is It Better to Buy Before or After EU Accession?

Historically, investors who buy before full accession capture:

-Lower entry prices

-Greater asset selection

-Stronger long-term appreciation

Once EU membership is confirmed, markets often price in the “EU premium” quickly.

Buying before EU accession often offers better long-term returns than buying after membership is finalized.

Long-Term Outlook for Montenegro Real Estate

EU accession positions Montenegro to transition from an emerging market to a European-integrated luxury destination.

Over the long term, investors can expect:

-Stronger price stability

-Lower systemic risk

-Increased international liquidity

-Sustained demand for premium real estate

EU accession supports long-term stability and appreciation in Montenegro’s luxury property market.

Investor Timeline: Montenegro Property Market (Pre vs. Post EU Accession)

Phase 1: Pre-Accession (Now – Accession Confirmation)

Market characteristics:

-Prices remain below comparable EU coastal markets

-Limited institutional competition

-Higher negotiating power for buyers

-Regulatory reforms in progress

Investor advantage:

Early entry pricing, wider asset choice, higher long-term upside.

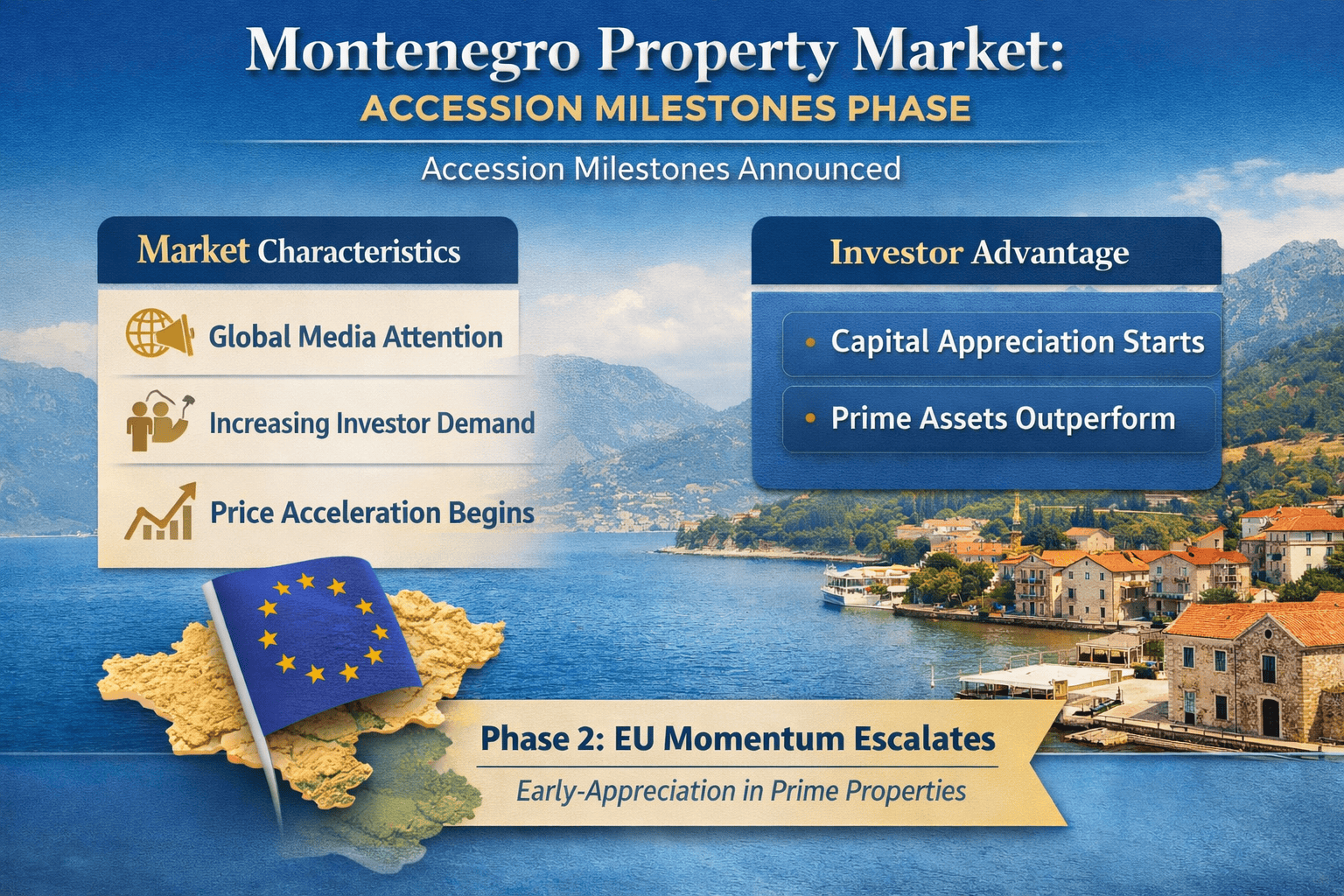

Phase 2: Accession Milestones Announced

Market characteristics:

-Increased media and international investor attention

-Rising demand in prime locations

-Early price acceleration in luxury segments

Investor advantage:

Capital appreciation begins; best-positioned assets outperform.

Find out: Montenegro Real Estate Investor Guide

Phase 3: Full EU Membership

Market characteristics:

EU-aligned legal and regulatory framework

Strong foreign capital inflows

Infrastructure fully integrated with EU funding

Reduced volatility, increased liquidity

Investor outcome:

Lower risk, stable appreciation, EU-level valuation benchmarks.

Historically, the strongest gains occur between late pre-accession and early post-accession, not after full EU membership is completed.

Final Investor Insight

EU accession is not a single event — it is a multi-year value-creation process. For long-term luxury real estate investors, Montenegro represents a rare combination of European alignment, lifestyle appeal, and early-cycle pricing.

Strategic positioning today allows investors to participate in Montenegro’s transformation before EU membership becomes fully priced into the market.

How EU Accession Could Transform Montenegro Property Values - Frequently Asked Questions

Will Montenegro property prices rise after EU accession?

Yes. EU accession typically increases property prices by improving legal certainty, infrastructure, and foreign investment demand.

Which areas benefit most from EU accession in Montenegro?

Prime coastal areas, marina developments, and established luxury destinations benefit the most.

Does Montenegro already use the euro?

Yes. Montenegro uses the euro, reducing currency risk for investors.

Is EU accession good for luxury real estate investors?

Yes. Luxury properties benefit most due to international demand and limited supply.

Are there risks in buying luxury propeties in Montenegro before EU accession?

Short-term regulatory changes may occur, but long-term fundamentals in Montenegro are strong.

Is Montenegro real estate undervalued compared to EU countries?

Yes. Many investors consider Montenegro undervalued relative to EU coastal markets.

اقرأ أيضًا:

كيفية التنقل في سوق العقارات في الجبل الأسود في عام 2026: الاتجاهات والتوقعات

For investors seeking early access to Montenegro’s most exceptional properties ahead of EU accession milestones, expert local guidance is essential. Contact us now or visit the Montenegro Sotheby’s Realty office in Porto Montenegro.